Secure Artificial Intelligence Tools and Machine Learning

We live in a fast-evolving age of information, where Artificial Intelligence (AI) tools are starting to be used in many areas like financial decision-making and

We live in a fast-evolving age of information, where Artificial Intelligence (AI) tools are starting to be used in many areas like financial decision-making and

Alt data firms started to emerge about a decade ago, and the sector has since progressed through several phases. But everything changed in a flash with the emergence of large language models (LLM) and ChatGPT. This moment can be viewed as an exponential leap in the evolution of alt data. Furthermore, when viewed through the lens of finance, this inflection point requires making several distinctions before attempting to apply the LLM phase of alt data.

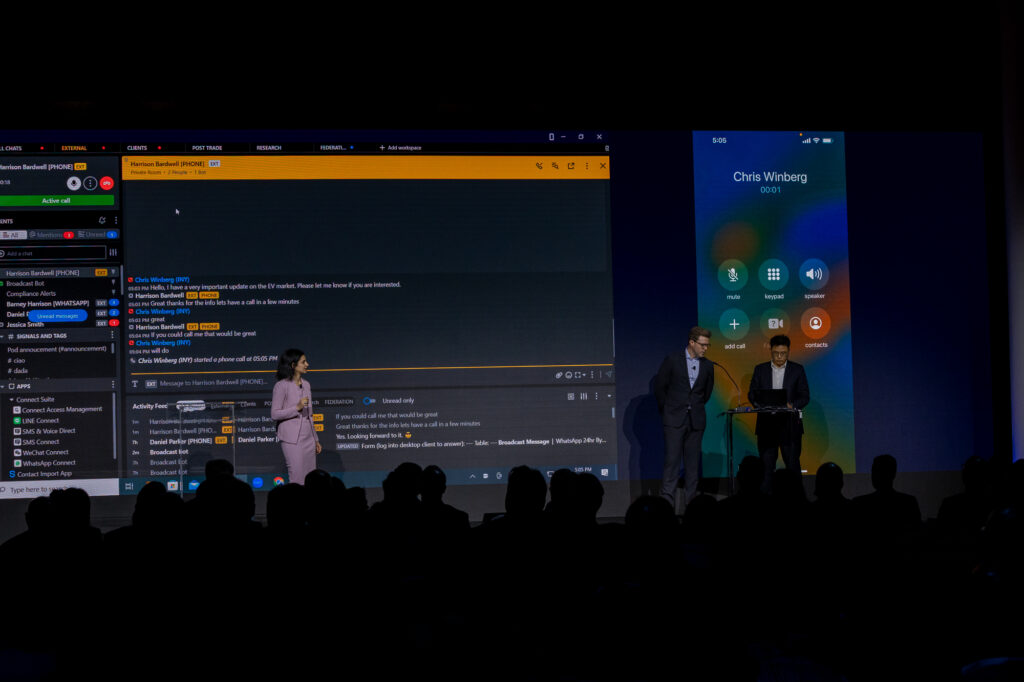

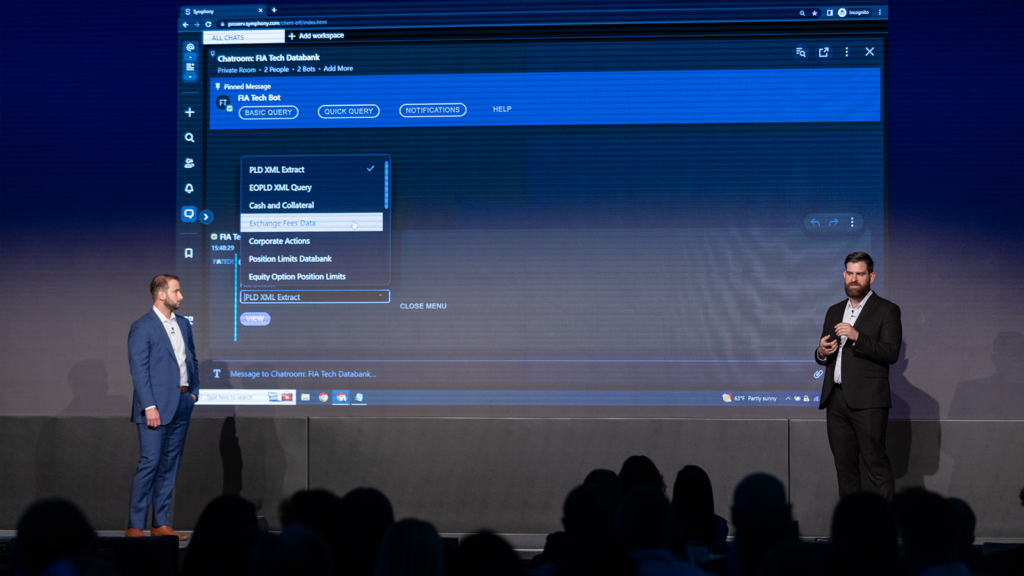

Symphony Innovate brings together industry leaders to share insights, showcase live demos of products and integrations, and provide case studies on how technological advancements have transformed the community. Join Symphony along with Cloud9, StreetLinx and Amenity Analytics as we discuss the future of the industry on 23 May in London.

Almost a decade ago, Europe led the way in shortening the settlement cycle to T+2 – a task that required wholesale re-engineering of European market-structure. Mere months from now, European securities firms will again be challenged – this time with the move to US NEXT-DAY settlement. Once more, our market participants face a complete restructuring of entire organisational workflows.

Our analysis of Q1 earnings calls within Symphony’s ESG platform highlights a flurry of development in renewables, especially in offshore wind, with “industrials” and “utilities” driving the topic count in management commentary.

Started in 2014 as a messaging platform to enable data security and compliance, today Symphony is a leading common connector for market workflows. Among other things, Symphony provides more than half a million users with secure tele-conferencing services. At the core of these services lies a piece of software tech known as Selective Forwarding Unit (SFU). We call it Symphony Media Bridge (SMB).

The SEC has adopted a final rule to shorten the standard settlement cycle for most securities transactions from two business days (T+2) to one business day following the trade date (T+1). The reduced settlement period is forcing companies to reexamine their post-trade processes and procedures, which include communication methods. This article discusses several operating model changes to help with the transition to T+1 ahead of the compliance deadline of May 28, 2024.

Ever since the financial crisis of 2018 led to the restructuring of the global financial architecture, market participants have been required to meet increasingly stringent regulatory requirements. This trend is only intensifying.

Smaller companies are often overshadowed by narratives from larger firms, especially during earnings season. This makes it difficult to measure performance, unless you can leverage NLP. Using data from Symphony’s ESG platform and further analyses, we highlighted narratives from smaller firms that showed significantly more growth in the past year compared to large-cap firms.